Mortgage Insurance: What It Is, Who Needs It, and Why

While some may never pay a cent of mortgage insurance in their lifetime, there are still plenty of borrowers that do. Some are even required to pay mandatory mortgage insurance premiums (MIP), depending on the home loan product that they've chosen. So just what is mortgage insurance, who has to pay it, and what is its purpose?

What is mortgage Insurance?

The first thing to note about mortgage insurance is that it's not coverage for the borrower. Mortgage insurance is actually a policy that protects the lender should the borrower default, pass away, or be unable to pay off the loan for any reason. This security enables lenders to be less strict about home loan eligibility.

Lenders lump mortgage insurance into your monthly loan payment, but sometimes they require you to pay an upfront premium (like with MIP for FHA loans), which can be paid in full at closing.

Who Has to Pay Mortgage Insurance?

Typically, banks require mortgage insurance for borrowers who have less than 20% home equity (for home equity loans) or who make a down payment of less than 20% of the purchase price of the home.

Mortgage insurance may be mandatory, depending on your mortgage program. For example, if you have a conventional home loan, lenders can require you pay private mortgage insurance (PMI).

If you have an FHA loan, a mortgage insurance premium (MIP) is a standard part of the loan agreement. Find more information on each of these below.

Private Mortgage Insurance (PMI)

If you’re shopping for a conventional home loan and your lender requires mortgage insurance, this is called private mortgage insurance (PMI). It is organized by lenders from a third party insurance company. If your down payment is less than 20% or you’re refinancing a home with less than 20% equity, you are liable for PMI.

Ideally, a borrower would have enough funds to make a substantial down payment of 20% or more. A large down payment reduces the risk of the loan and makes the mortgage more secure.

But many home buyers, especially first-timers, don’t have the funds to make such a huge down payment. In this regard, the PMI benefits both the borrower and the lender -- it allows the borrower to make a lower down payment, while reducing the risk to the lender.

The good news for the borrower is that PMI may be cancelled once you’ve accumulated at least 20% home equity. This amount is determined by whichever of the following options is less:

The home price at the closing of the loan, or

The market appraised price.

The PMI may be cancelled automatically or upon request. Automatic cancellations usually happen when you’ve reached 22% equity, but once equity is 20% the borrower has the right to request its cancellation. To avoid any misunderstanding or over payment of premiums, make sure you’re aware of your contractual expectations and rights.

The more common type of PMI is borrower-paid private mortgage insurance (BPMI). You can expect to pay PMI premiums of 0.25 - 2.00 percent of the loan amount. The premium is determined by factors including down payment, loan amount, and credit score.

The PMI may be paid monthly along with your loan payments, as a single upfront payment, or a combination of the two. Ask your lender about which monthly payment options they offer and what would work best for your financial situation.

Note that it is possible for the lender to pay the insurance premiums for you. This is called lender paid private mortgage insurance (LPMI). The LPMI will result in lower payments for you since your lender foots the insurance bill, but a higher interest rate -- meaning you may actually pay more in the long-run. In addition, LPMI doesn’t get cancelled even after you have accumulated 20% equity or more because it is a permanent part of the loan.

FHA Loan Mortgage Insurance Premium (MIP)

FHA loans are a great option if you don’t have the money for a substantial down payment. They offer you the chance to make down payments as low as 3.5% and to use money gifted to you by family or friends.

Because the FHA loan program offers so much leeway on the down payment, the program requires you to pay mortgage insurance to mitigate the risks of a default. However, you are only required to pay FHA mortgage insurance if your down payment is less than 20% or you are refinancing a home with less than 20% equity.

The Two Parts of FHA Mortgage Insurance

Mortgage insurance for FHA loans comprises two parts: the upfront mortgage insurance premium, and the annual mortgage insurance premium.

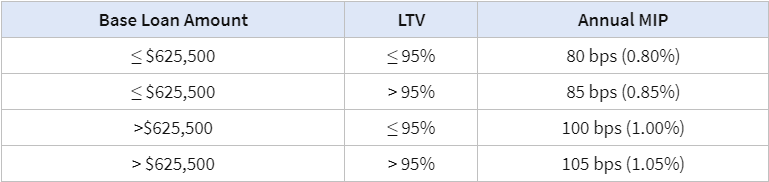

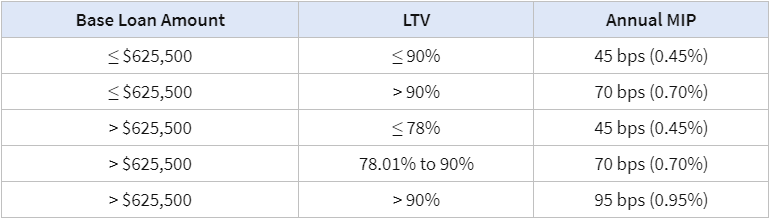

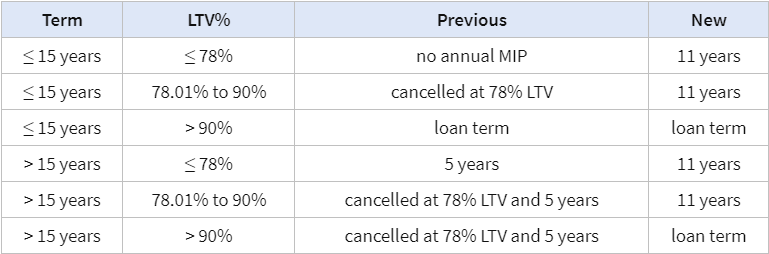

The upfront mortgage insurance premium (UMIP) is due at the closing of the loan. The UMIP is calculated as 1.75% of the loan amount. The annual mortgage insurance premium (AMIP) varies according to the loan amount, duration, and loan to value (LTV) ratio. The AMIP is calculated as an annual figure but it is paid monthly along with the loan payment.

For a better look at how AMIP is calculated, please see the tables below.

AMIP Rates for Loan Terms Over 15 Years:

AMIP Rates for Loan Terms Up to 15 Years

How Long you Will Have to Pay AMIP:

Here’s an example of how the UMIP and the AMIP works.

Assume you had an FHA loan for $300,000, payable over 30 years with an LTV of 90%. You would be required to pay UMIP of $5,250 (1.75% of $300,000).

Your AMIP would be $2,400(0.8% of $300,000) payable as monthly installments of $200 ($2,400 ÷ 12) for the entire mortgage term.

Mortgage Insurance: In review

Mortgage insurance makes it possible for those with low down payments to be eligible for a loan, but it does get expensive over time. If you can, it’s a good practice to only opt for mortgage insurance when you can’t raise enough funds to get 20% equity. You should also note that the higher your down payment is, the lower your mortgage insurance will be, even if you are under the 20% threshold. That’s why it’s smart to try to raise as much money for your down payment as possible.

The Federal Housing Administration, or FHA, insures mortgage loans to help home buyers who may not be eligible for a conventional home loan due to less-than-perfect credit or lack of savings for a down payment. An FHA loan can be used to buy almost any type of home including modular, manufactured, or mobile homes -- and can also serve to purchase homes facing foreclosure.